BY: JANN SWANSON

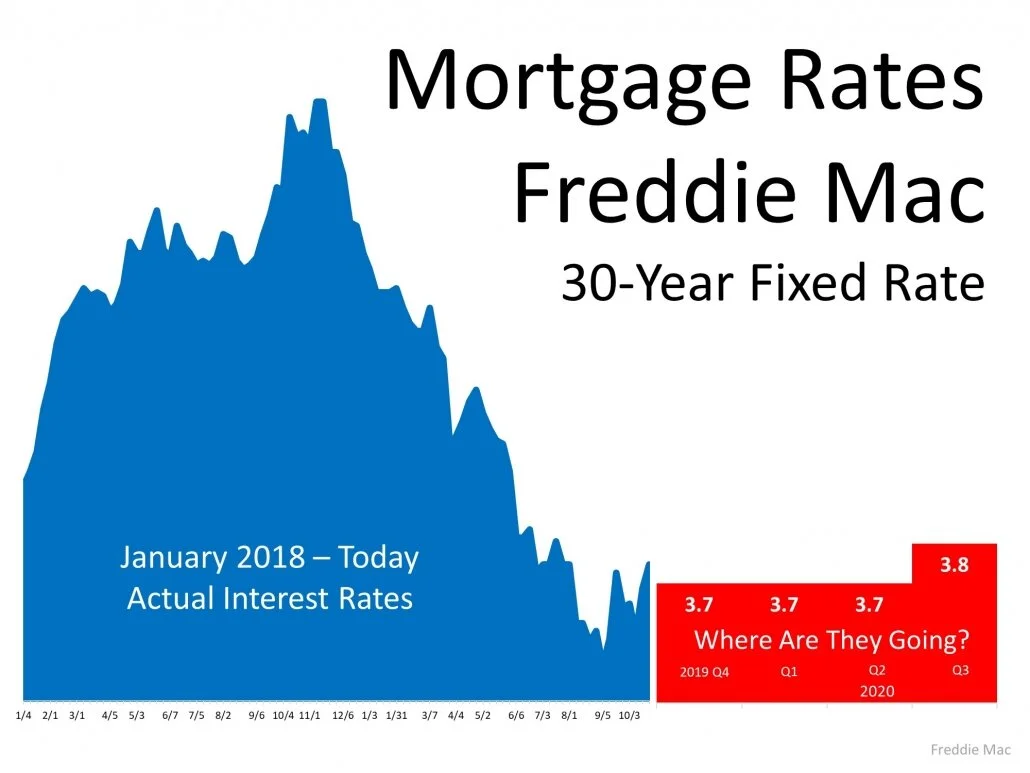

While the increase wasn't as strong as in July, last month's existing home sales posted a second straight month of gains and, as previously, the National Association of Realtors® (NAR) credited falling interest rates. Sales of previously owned single-family houses, townhouses, condominiums, and cooperative apartments were up 1.3 percent compared to July when sales rose 2.5 percent. The seasonally adjusted annual rate of 5.49 million units was 2.6 percent higher than the August 2018 pace of 5.35 million. The increase was felt in three of the four major regions while the West continues to demonstrate some weakness.

The month's results were better than predicted. Analysts polled by Econoday had expected them to come in at an annual rate of 5.30 to 5.42 million with a consensus of 5.38 million.

Single-family home sales rose from 4.84 million in July to 4.90 million in August, a 1.2 percent gain and 2.9 percent above the August 2018 rate. Existing condo sales rose 1.7 percent from July to 590,000 annual units, largely unchanged from the previous August.

Lawrence Yun, NAR's chief economist, said, "As expected, buyers are finding it hard to resist the current rates. The desire to take advantage of these promising conditions is leading more buyers to the market."

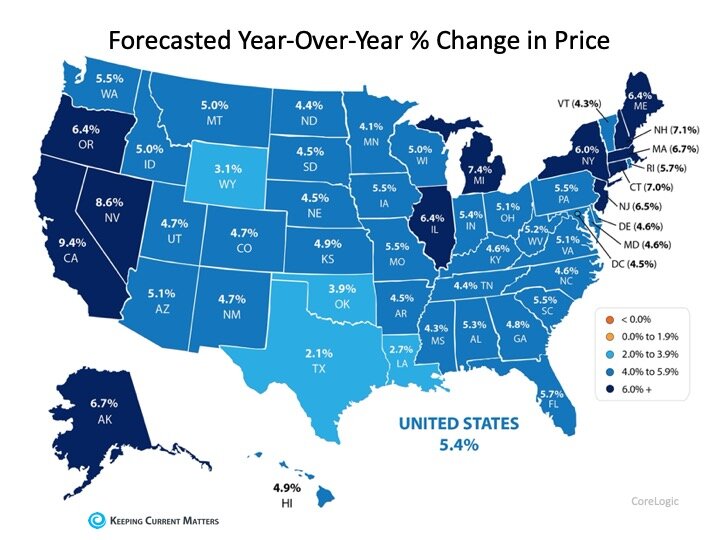

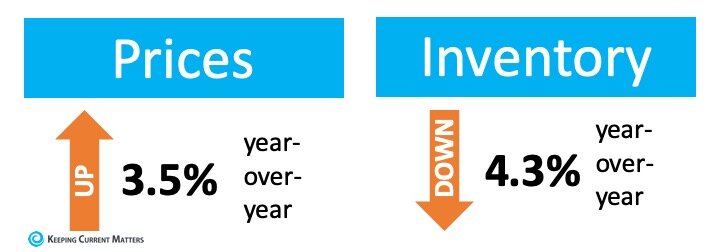

The median existing home price for all housing types in August was $278,200, up 4.7 percent from the median a year earlier of $265,600. It was the 90th straight month of year-over-year gains. The median existing single-family home price also rose 4.7 percent to $280,700. Condo prices were up 5.2 percent to a median of $257,600 in August.

"Sales are up, but inventory numbers remain low and are thereby pushing up home prices," said Yun. "Homebuilders need to ramp up new housing, as the failure to increase construction will put home prices in danger of increasing at a faster pace than income."

Inventory fell in August, down from 1.90 million available homes to 1.86 million and 2.6 percent fewer homes than a year earlier. Unsold inventory is at a 4.1-month supply at the current sales pace, down from 4.2 months in July and from the 4.3-month figure recorded in August 2018. Properties typically remained on the market for 31 days in August, up from 29 days in both July and the prior August. Forty-nine percent of homes sold in August were on the market for less than a month.

Yun criticized the quarter point cut in the Fed Funds rate made by the Federal Reserve on Wednesday. "[The Fed] should have been bolder and made a deeper rate cut, given current low inflation rates," he said. "The housing sector has been broadly underperforming but there is huge upward potential there that will help our overall economy grow."

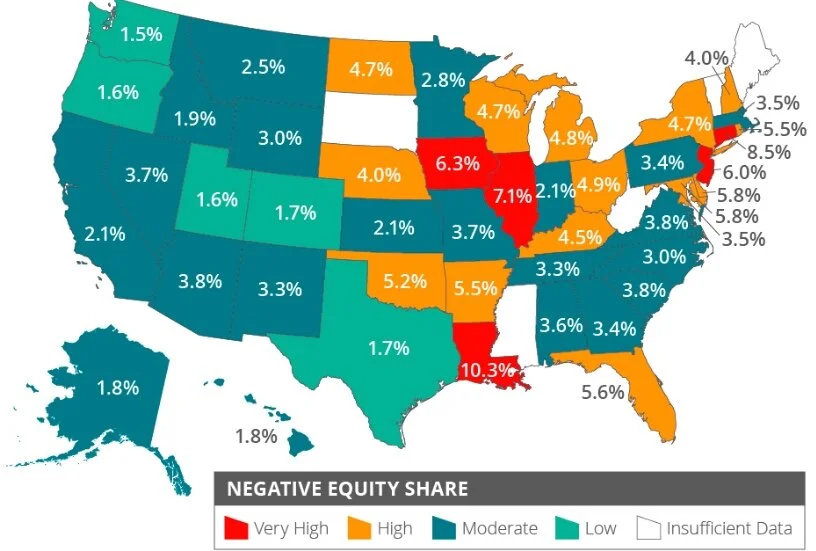

First-time buyers were responsible for 31 percent of sales in August, the same as a year and investors and second home buyers accounted for 14 percent, up from 11 percent in July. All-cash sales accounted for 19 percent of transactions in August, about equal to July and moderately below August 2018. Distressed sales remained negligible, representing 2 percent of August sales, a 1-point decline from a year earlier.

"Rates continue to be historically low, which is extremely beneficial for everyone buying or selling a home," said NAR President John Smaby. "The new [FHA] condominium loan policies, as well as other reforms NAR is pursuing within our housing finance system, will allow even more families and individuals in this country to reach the American Dream of homeownership."

There were month-over-month increases in existing home sales in the Northeast, Midwest, and South and sales in all four regions bested their 2018 numbers. Sales in the Northeast increased 7.6 percent from July to an annual rate of 710,000 units, 1.4 percent higher than in August 2018. The median price fell 0.3 percent on an annual basis to $303,500.

Existing-home sales grew 3.1 percent in the Midwest to an annual rate of 1.31 million, topping sales from a year earlier by 2.3 percent. The median price jumped 6.6 percent to $220,000.

In the South there was a gain of 0.9 percent in sales to a rate of 2.33 million and sales were 3.6 percent higher year-over-year. The median price of $240,300 was a 5.4 percent annual increase.

While sales remained 1.8 percent higher on an annual basis, the West was an outlier in August. Existing home sales declined 3.4 percent to 1.14 million. Prices, however, continued their strong appreciation, rising 5.7 percent to $415,900.